Every person whether or not resident is chargeable to RPGT on gains arising from disposal of real property including shares in a real property company RPC. For detail of informstion on RPGT reference can be made to the RPGT Guidelines dated 13062018 or 18062013 whichever.

Essentially RGPT is a tax levied on chargeable gains from the disposal of chargeable assets such as houses commercial buildings farms and vacant lands.

. As RM 20000 is higher so we use RM 20000. Property taxes can be troublesome and. The Real Property Gains Tax Exemption No3 Order 2018 which was gazetted on 31 December 2018 exempts any individual who is a citizen or permanent resident of Malaysia from payment of real property gains tax on the chargeable gain accruing on the disposal of a chargeable asset excluding shares in a real property company if the following conditions are.

The disposal is made in the sixth year after the date of acquisition of such chargeable asset or any year thereafter. Real Property Gain Tax RPGT 2019. Real property gain tax 2018.

2 April 2018. RPGT Payable Nett Chargeable Gain x RPGT Rate. It is the tax which is imposed on the gains when you dispose the property in Malaysia.

Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976. RPGT applies to both residents and non-residents. If you owned the property for 12 years youll need to pay an RPGT of 5.

RPGT stands for Real Property Gains Tax. Budget 2022 RPGT Change Removed the 5 RPGT for properties held for more than five years by Malaysian citizens and permanent residents effective 1st January 2022. Real property gain tax malaysia 2018.

Malaysian citizens and permanent residents will no longer have to pay RPGT when selling their property on the sixth year onwards. TaXavvy is a newsletter issued by. A chargeable gain is the profit when the disposal price is more than purchase price of the property.

RPGTA was introduced on 7111975 to replace the Land Speculation Tax Act 1974. In general real property is defined by the RPGT Act 1976 as any land in Malaysia as well as any interest option or other right in or over such land. An RPC is a company holding real property or shares in another RPC which value is not less than 75.

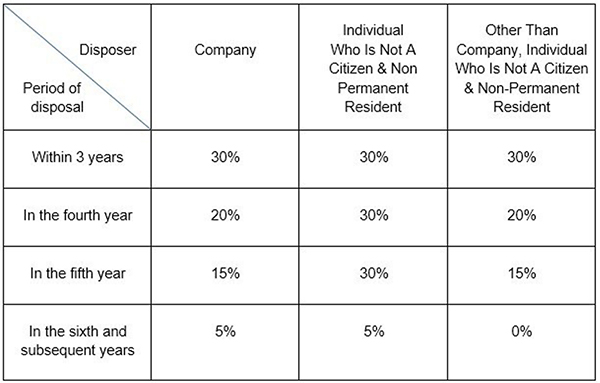

This Order does not exempt an individual from the requirement to submit the relevant return under the Real Property Gains Tax Act 1976. Gain accruing to an individual who is a citizen or a permanent resident in respect of. The RPGT rates are as follows-.

Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5. Gallery Real Property Gain Tax RPGT. RPGT is a tax chargeable on the profit gained from the disposal of a property and is payable to the Inland Revenue Board.

What is Real Property Gain Tax RPGT. The Real Property Gains Tax RPGT is tax on profits made from the sale of real estate. Individual Citizen PR Individual Non-Citizen For Disposals Within 3 years.

Real Property Gain Tax RPGT 2019. Real Property Gain Tax Amendments that Property Sellers and Non-Citizen must know The latest amendments in the Real Property Gain Tax 1976 has greatly impacted non-citizen and non-permanent resident property owners in Malaysia. RGPT was first introduced by the Malaysian Government under the.

A 360 gazetted on 28 December 2018 provides that a Malaysian citizen individual is exempted from real property gains tax RPGT on the chargeable gain derived from the disposal. Real property gains tax exemption on the disposal of low-cost medium-low and affordable residential homes. RPC is essentially a controlled company where its total.

Alternatively the homeowner may own a land larger than 1 acre or earn more than RM 500000 through yields from the properties. For example if you bought a house for RM250K and sell it at RM350K the profit of RM100K is chargeable under RPGT but you may be entitled to deduct expenses such as. Amendments on Paragraph 122a b Gift of property between spouses parent to child or grandparent to grandchild.

Real property gain tax malaysia 2018. It was suspended temporarily in 2008-2009 and reintroduced in 2010. Real property is defined as any land situated in Malaysia and any interest option or other right in or over such land.

Home real property gain tax 2018. Thus your final chargeable gain is RM 180000 3 If you sell your property on the 6th year onwards the RPGT applicable is 5 of RM 180000 which is RM 9000. In simple terms a real property includes land or immovable property with or without title.

The gain is payable when the resale price disposal cost of the property is higher than its purchase price acquisition cost. Contact Us At 6012-6946746. Based on the Real Property Gain Tax Act 1976 RPGT is a tax on chargeable gains derived from disposal of property.

Youll pay the RPTG over the net chargeable gain. Third according to the RPGT Exemption Order 2018 PU. Introduction The Finance No 2 Act 2017 FA received royal assent on 27 December 2017 and was introduced to amend the Income Tax Act 1967 the Real Property Gains Tax Act 1976 RPGTA the Goods and Services Tax Act 2014 and the Finance Act 2013.

The Real Property Gains Tax Exemption Order 2018 PU. REAL property gains tax RPGT is a tax charged on gains arising from the disposal or sale of real property or shares in a real property company RPC. Real Property Gain Tax RPGT 2019.

A 360 and the RPGT Amendment Order. Gallery Real Property Gain Tax RPGT 2019 Latest News and Update. Youve got questions Weve got answers.

To have commercial property to be taxable under the 6 GST the homeowner must own 2 or more commercial properties or a commercial property valued at more than RM 2 million. Youve got questions Weve got answers. Home real property gain tax malaysia 2018.

The consideration for the disposal of the chargeable asset is not more than RM200000-. Contact Us At 6012-6946746. Real property gains tax exemption on the disposal of low-cost medium-low and affordable residential homes.

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

The Liberal Party S Housing Policy Does Not Include A Capital Gains Tax On Primary Home Sales Fact Check

Real Property Gains Tax Rpgt Gl Property Consultancy Facebook

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Key Changes In The Real Property Gain Tax Cheng Co Group

Real Property Gains Tax Its Exemptions Publication By Hhq Law Firm In Kl Malaysia

Real Property Gains Tax After Death Rockwills Info

Guide To Malaysian Real Property Gain Tax Rpgt

6 Steps To Calculate Your Rpgt Real Property Gains Tax

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

Zerin Properties Real Property Gains Tax

Here S How You Can Make A Profit From Subletting

Gifting Of Real Properties Between Immediate Family Members Thannees Articles

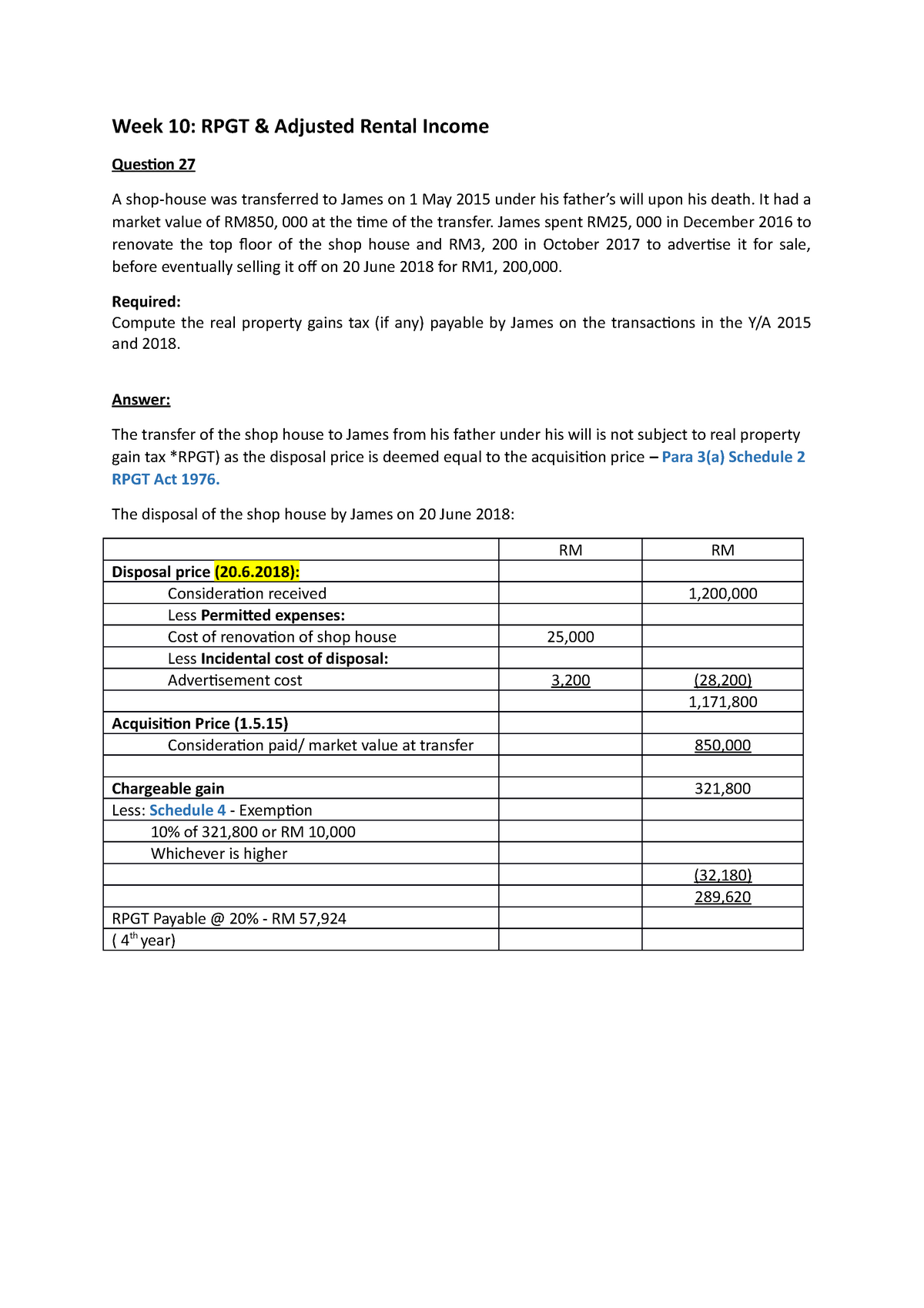

Rpgt Rpgt Answers Week 10 Rpgt Amp Adjusted Rental Income Question 27 A Shop House Was Studocu

What Is Real Property Gains Tax The Malaysian Bar

Key Changes In The Real Property Gain Tax Cheng Co Group

Understanding How Real Property Gains Tax Rpgt Applies To You In Malaysia